How Employees and Independent Contractors Differ in 5 Key Ways

Aug 15, 2023

Are you considering expanding your solopreneur operation of your online business to include one or more team members? When you are a course creator, coach, membership or service provider thinking about creating your team or making your first hire, you’ll need to understand whether you are hiring employees or independent contractors. How workers are classified isn’t up to the company hiring them. How workers are classified depends on the degree of control the employer has over the worker and how the work is performed. Companies cannot change the legal status of an employee or contractor by written agreement. Instead, several factors are reviewed to determine how the worker should be classified. If the hiring company gets it wrong, the penalties imposed by government agencies for misclassification of workers can be significant, and workers can also make claims against the company, even if they agreed initially to the misclassification. This blog reviews the five basic differences between employees and independent contractors so that you understand the basic differences between these two classifications.

Difference No. 1: How You Pay Your Worker

One of the most basic differences between employees and independent contractors is how they are paid. Independent contractors are paid a fee for their services. This fee might be structured as an hourly rate or a fixed price for a specific set of services. Employees on the other hand, are paid wages. An employee might be paid an hourly wage, or they might be paid a salary. If employees are paid an hourly wage, they are considered to be non-exempt employees, and employees that receive a salary are considered exempt employees. The difference between exempt and nonexempt employees is the discussion of a future blog post, but for now remember that the difference between exempt and nonexempt employees is an important one once you decide to hire employees. A company can’t automatically put an employee on salary unless their job and pay meet certain requirements.

Knowing that employees are paid wages, and not a fee for services, is important because there are many federal, state and local laws and regulations that govern the payment of wages. Workers classified as employees are entitled to minimum wage and possibly overtime pay (if they are nonexempt). Some state laws may also classify certain types of pay, like vacation or sick pay as wages, and some state laws dictate how frequently employees must be paid.

Independent contractors, by contrast, are paid according to their contractual arrangement with the company that hired them. They may be paid hourly, by the project, or on retainer, and may receive pay weekly, monthly or by the project. Independent contractors are not subject to overtime pay and they don’t receive benefits, like vacation or sick pay, so these are not factors that a company needs to consider when structuring a fee system with their independent contractors.

Difference No. 2: Term of Engagement or Length of Service

When you hire a worker as an employee, most often they are considered an employee-at-will. This means that either the company or the worker can terminate the employment relationship, at any time, with or without notice and with or without cause. Some employees have employment contracts, but these are usually reserved for higher level executives or managers or employees in specific industries, like technology. This means that employees-at-will continue to work in their position until either the employer or the employer decides to end the relationship.

In contrast, independent contractors are working under a contractual relationship with the company. They may be working on a specific project, and the contract ends when the project ends. They may be working on a retainer type of arrangement, performing repetitive or tasks that are assigned to them as needed within their specific area of expertise. Contracts between independent contractors and the companies that engage them usually have notice provisions for terminating the relationship, which are spelled out in the contract. If either party breaches the terms of the contract, then the other party may have a claim against the breaching party.

Difference No. 3: How Taxes are Handled

Independent contractors are 100% responsible for payment of all of their own taxes. They provide the company that hires them with a W-9 form, and at the end of each calendar year the company issues them a 1099. The IRS provides a video to assist in completing the Form W-9, IRS Video to Complete Form W-9. This means that independent contractors must pay 100% of their income tax, social security tax and medicare tax directly to the government. The company they work for does not withhold taxes. Estimated tax payments are due from independent contractors on a quarterly basis, and then are reconciled when the worker files their income tax return. Any underpayments must be made up, and overpayments are issued as refunds.

Employees are responsible for 100% of their income taxes, but their employers pay a portion of their social security and medicare taxes. Employees complete a W-4 form, instructing their employers how much income tax to withhold from their paychecks. When the employee files their tax returns, they reconcile any overpayment or underpayment of taxes during the calendar year using the W-2 form issued by their employers. Employers also pay a portion of their employees’ social security and medicare taxes. Employers are required to turn over all taxes withheld, as well as their contributions to social security and medicare taxes usually on a quarterly basis to federal, state, and sometimes local taxing authorities.

Difference No. 4: Legal Protections for Workers

Independent contractors have very few legal protections as workers. Their relationship with the company that hires them is governed by their contract. If they are upset with their relationship with the company they are working for, their main avenue of relief would be to make a claim under their contract. You can learn more about making your contracts enforceable in my Blog Three Essential Components to Make Your Online Business Contracts Enforceable.

Employees, on the other hand, are entitled to many laws that protect the rights of workers in the United States. These protections may be federal, in which case they apply to workers in all states, or they may be state specific and apply only to workers living in a particular state. If a company offers benefits, like health insurance or a retirement plan, workers are protected by laws regulating these benefits.

Difference No. 5: Degree of Control Over the Work

In terms of determining whether a worker is an employee or an independent contractor, this factor is the most important one. Independent contractors have control over the methods and manner of performing the work. The company controls the result, but not how that result is achieved. At the heart of the analysis of whether a worker is an independent contractor or not is who has the right to control the work, not whether the company actually exercises that control.

In contrast to independent contractors, employees do not have the right to control their work. Their employer determines how the work is to be performed, sets the employees hours and place of work, and typically provides all of the tools necessary to perform the job. Even if the company has a flexible work arrangement, it is the company that has the right to control the manner and method of performing the work.

Once determining that the company does not have the right to control the work, this doesn’t end the analysis as to whether the worker is an independent contractor. There is a further analysis that dives deeper into the details of how the work is performed to determine whether the worker is an independent contractor or an employee. There is a lot of gray in this area, and to complicate matters every state also has its own set of factors to apply to determine worker classification. It’s usually easy to identify situations that are at the extremes - either an employee at one end of the spectrum or an independent contractor at the other end of the spectrum. It’s all of the gray areas in the middle that can make it difficult to correctly classify the worker.

Before paying someone as an independent contractor, it’s extremely important to check with the state laws where the worker lives. While one state may permit a worker that meets the tests under Federal law to also be classified as an independent contractor under that state’s law, a different state’s laws may require that same worker be classified as an employee. To make the correct determination about a worker’s classification, it is essential to analyze both the work that will be performed as well as the applicable legal requirements.

Summary: Be Sure To Get Worker Classification Correct in Your Online Business

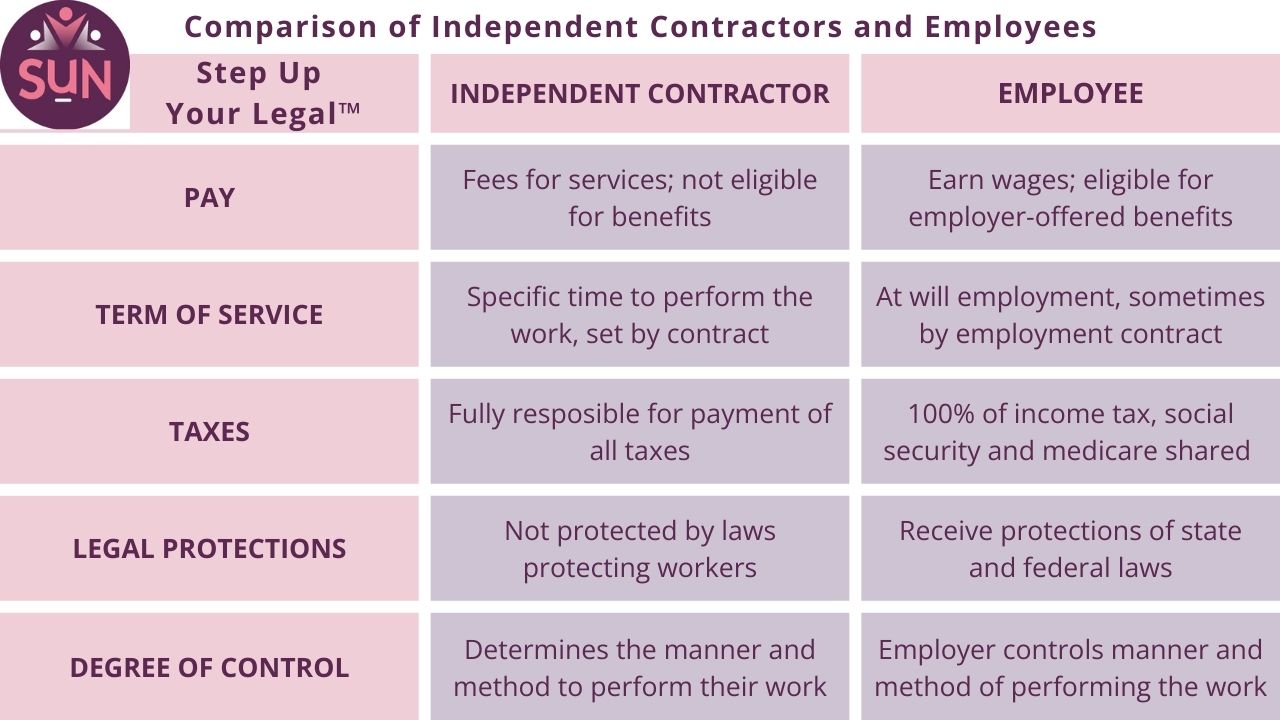

This chart gives a side by side comparison of the five main differences between an independent contractor and an employee, as discussed above:

If a company misclassifies its workers, this can result in significant fines and penalties from both federal and state governments, as well as claims from the worker. When a worker is an employee, the employer is required to obtain workers’ compensation insurance, unemployment insurance and withhold all applicable taxes that may be imposed at the Federal or state level. Some states collect taxes other than income tax, for example contributions to cover family and medical leave. By taking the time when the worker is hired to determine the correct classification, employers can significantly reduce their risk of fines, penalties and back taxes, and claims made by workers who were not properly classified.

In a future blog post, we’ll cover in more depth the analysis to determine if a worker can be properly classified as an independent contractor. If you do have independent contractors working in your business, do you have contracts in place with them? If you’re in need of a contract template for your independent contractors, be sure to check out The Step Up Your Legal™ Template Shop. The Template Shop has a customizable independent contractor agreement that comes with an easy to follow video so you can complete the form in a few easy steps.